A brief description of a Reverse Mortgage:

First, a disclaimer: I know about reverse mortgages but I am not a provider of them and I don't receive any compensation from them. I market houses, not mortgages but my Clients are purchasers of mortgages so I need to know all about them.

HECM stands for Home Equity Conversion Mortgage but it's "street" name is Reverse Mortgage. This is is a FHA insured loan, for Seniors age 62 and above and is placed ONLY on their principal residence. In the case of a couple (or even 2-3 unrelated but jointly owning and living in the home,) the mortgage is based on the age of the younger. If one is on the deed, they have to be on the mortgage. In a regular mortgage, you have payments. In a Reverse Mortgage, you do not. That is the biggest difference. Since you do not have a payment, credit is not a big concern. Neither is income. So... how does the lender (bank) make it’s money? Well, in a regular mortgage you have payments of two components - Interest and Principal. Since a Reverse Mortgage does not have a payment, the interest each month is just added to the principal. At whatever point the mortgage is paid off, the bank gets it’s principal and interest in one lump sum. You still have to pay your property taxes, insurance and reasonable maintenance on the home. One huge benefit is that you can never owe more than what the home would sell for and there is NO personal or estate liability - BY CONTRACT! Worth considering in these “interesting” days. This takes the worry of a mortgage and the sale of your home off the table. It's a heads you win and tails, you don't lose - i.e. when the house sells and the net proceeds after the mortgage is paid is greater than zero, you or your estate keeps it. If the net is less than the mortgage, there is no liablilty. Just hand the keys to the bank. Really!

There are two basic flavors of a Reverse Mortgage: A full cash out of all available funds at closing and a line of credit that you can take out, pay back, take out, etc. A full cash out reverse can be either a FIXED rate (currently 4-5%) or a VARIABLE rate. A line of credit is ONLY a Variable rate. The variable rate is based on the one month LIBOR and is currently about 2.5%.

Note: This is a constantly changing program - it is a FHA (government) product and they like to fiddle with it. Check with several providers to find out what the CURRENT rules and policies are for you. Make sure you are getting the FHA product as there are always folks out there who are, shall we say, less than honorable.

Popular Belief Negatives:

Remember, a person that is automatically negative on Reverse Mortgages probably does not understand them and has one or more of the misconceptions mentioned below.

The bank owns my home?” Nope, it’s just a mortgage and you retain ownership.

“It is too expensive ?” Well like most purchases, you have to be a good shopper. Some providers have too high of an origination fee. Some have none. Another fee is the FHA “Up Front” mortgage insurance. There, it’s a “not necessarily” fee. You can dodge this fee (currently 2% of the appraisal amount) by taking less proceeds - a program some lenders offer as the “Saver” program. All things considered, the fees are in line with regular mortgages. Again, compare and pick your lender carefully.

“After a while the bank can kick me out of my home!” Again, nope. As long as you live in the home as your principal residence or until you reach age 150 (really true,) the bank cannot “kick you out” as long as you pay your taxes and insurance.

“What happens when I/we no longer occupy the home as our principal residence?” The mortgage has to be paid off. Either refi traditionally or, in the case of most, just sell the home and pay off the mortgage. It’s a “heads you win and tails you don’t lose” proposition. If you can sell the home for more than the mortgage, the extra goes in your or your estates pocket. If the value has declined and you are “upside down” then, no problem, just hand the keys to the lender - it’s their problem because, by contract, you have no personal or estate liability. Really!

Popular Questions:

“So... how much can I get?” Well, it depends on your age and the appraised value of your home and which type of reverse mortgage option you want. For simplicity sake, the proceeds of a Reverse Mortgage will be about half of the appraised value of your home. The older you are, the higher the percentage you can get out. Remember, you are not selling the home you are just getting a mortgage.

“OK, how does this benefit me?” Well, I said it is a great tool so let’s look at several options:

Broadly speaking, I like this product because it allows you to have some (perhaps all) your equity out of the house into your "own bucket" that YOU control and that bucket is very portable. Remember 2008-2012 when it was very hard to sell a home?

Cash out, get rid of the existing mortgage and have no more mortgage payments the rest of your lives. This is the most popular and allows you to “take your home off the table.” You don’t have to worry about it’s value any longer. If it goes up, great - if it goes down, it doesn’t matter. You’ve taken a good chunk of your equity out and protected yourself.

Create a Line of Credit for the “if” in life. However, this line, unlike a traditional line at the bank or a Home Equity Line of Credit (HELOC) has some advantages. It has no required payments, it cannot be cancelled and it cannot be reduced. And, again, no personal or estate liability. Huge advantages!!!

OK - So what is this article doing in a Realtor’s website? That’s a fair question. First, I know the product really well and I think it’s a great product for Seniors and I want you to know about it. HOWEVER, there are two places that you can benefit where I, as a Realtor, would be involved.

Take some equity out of your present home on a Reverse Mortgage and buy your vacation home in Florida or the mountains, etc. while they are on sale! Pay cash for them and rent them out until you want to move to Florida. Sell your home here, move to Florida, get a Reverse on your new principle residence there and you have additional money to fund your retirement. I’ll refer you to a great Realtor in Florida or the mountains!

Or.... Use the Reverse Mortgage to pick up on some investment real estate. Since mortgages are hard to get, there are a lot more folks out there who need to rent. Rent rates are going up. Buy a rental house (again while they are on sale) for cash and rent it out. Take away the taxes, insurance and maintenance and the rest of the rent is YOURS! Now you just added income to your present retirement! Of course, as a seasoned real estate investor, I can help you with your investment real estate.

Lastly, Did you know you can do a Reverse For Purchase? Yep. Let’s say that you have $200,000 that you wanted to buy your retirement home with and have no mortgage payments. Fair. Happens a lot. Now, if you do a Reverse For Purchase, you put up (in round figures) about $90,000 of your money and let the Reverse lender put up the remaining amount of $110,000. Now you just bought a $200,000 home, you have no mortgage payments for the rest of your life and you still have $110,000 of your original $200,000 in your pocket for a rainy day fund. Now, that’s a good use! Of course, I’ll help you find that “Just Right” retirement home for you!

Maybe this is a good solution for your parents who have diminished equity in their home. I’ll sell their existing home and we’ll find them a better “downsized” home for their retirement.

This has been Reverse Mortgage in it’s briefest form. I can probably help you with a vendor selection and I would be pleased to answer any questions you have. And, of course, I would be pleased to be your Realtor for that new retirement home or your investment real estate.

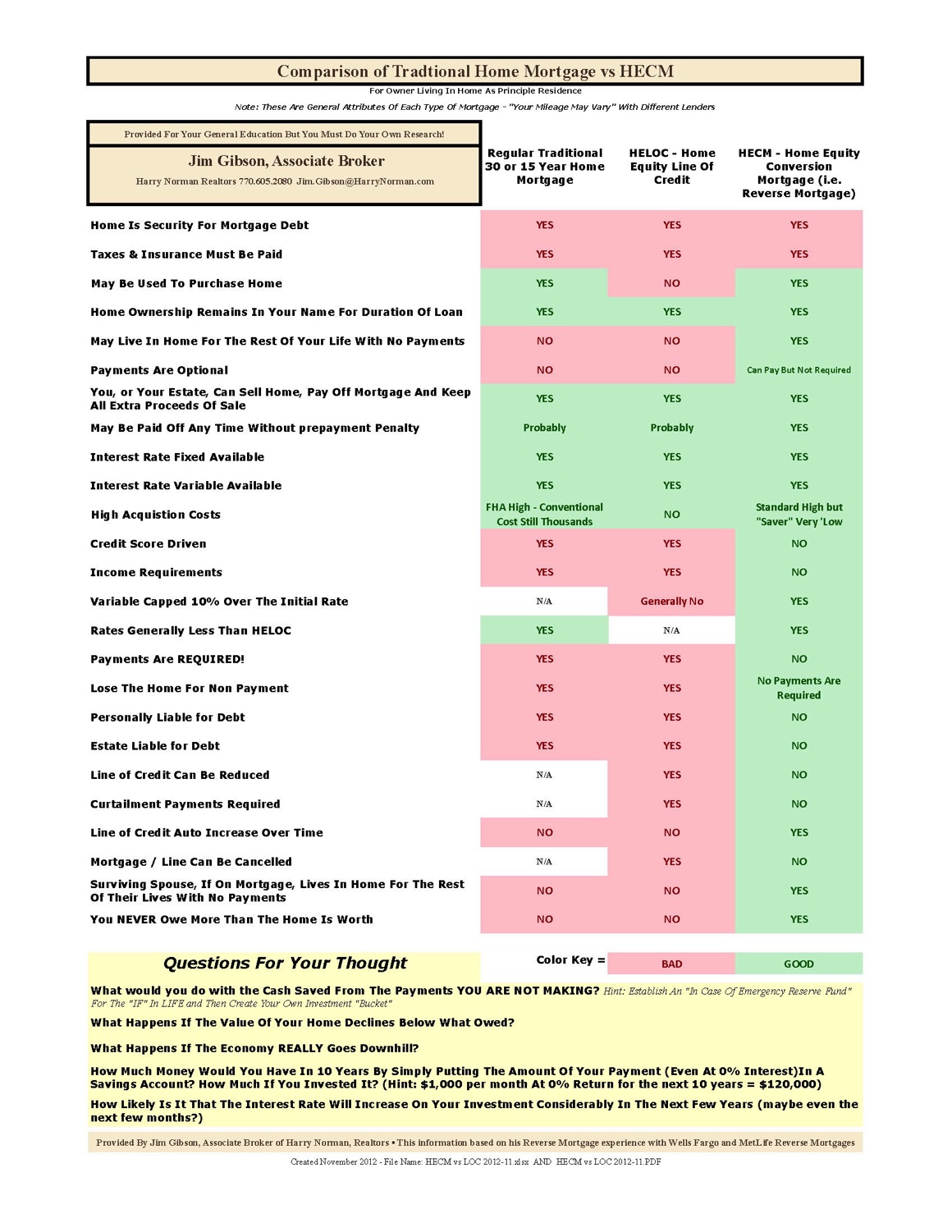

HECM aka Reverse Mortgages

Here is a presentation I did in 2012 to present to a group of Realtors. It is for informational purposes only and, please note, the rules and policies of FHA have probably changed several times since them. Still, the basics are there so here is your opportunity to know more about them. Just remember to do your own due diligence as "Your mileage may vary."

You may try hitting the right arrow to assist you to navigate through the movie since it was designed as a PowerPoint presentation.

Note: This chart was constructed in 2012 utilizing information current at that point. Be sure to do your own research for current rules and policies.

Note: This chart was constructed in 2012 utilizing information current at that point. Be sure to do your own research for current rules and policies.